Orkambi is in the news today. It is a life-extending drug for cystic fibrosis. It will be available on the NHS in England, health bosses say.

NHS England reached a deal with Orkambi manufacturers Vertex Pharmaceuticals after months of talks. Patients should be able to get the drug within 30 days. The drug improves lung function and reduces breathing difficulties and can be given to children as young as two. The firm wanted to charge £100,000 per patient per year but a compromise has been reached in a confidential deal.

Why was it's availability ever in doubt given the benefits that accrue to cystic fibrosis patients? The reason COST v BENEFIT.

I would like to discuss some of the issues involved here because it is legitimate and complex debate that should be faced up to. However for some there is no debate to be had - cost should not feature as a consideration if there is any derived health benefit for anyone.

In the UK the debate distills down to this - do you believe NHS finances are finite or not?

A CLEAR & SIMPLE POSITION

You believe if it is possible to help someone with a health issue (regardless of cost or marginal benefit) then the NHS must offer it as a moral imperative.

If this is what you believe there is no debate to be had - or at least there is no debate you are prepared to engage with.

Is this position realistic. Is it sustainable. Is it actually as moral as it appears ? Some would argue this position is a "cop-out". It is a naïve position - a idealist one - one that does not stand up to scrutiny in the "real" world.

A "REALISTIC" POSITION

We acknowledge the NHS budget has to be finite because it is funded from taxation (and borrowing) and therefore tough decisions have to be made about how the finite budget is spent. Once you accept this reality you are faced with a "Pandora's box".

AN EASY (GLIB) RESPONSE

While I accept the NHS has a finite budget the UK is the 5th largest economy in the world. We are a rich nation. We should tax the rich more, tax corporations more - we should stop wasting money elsewhere and spend it on the NHS. End of argument. (in effect saying NHS has an infinite budget).

A HARSH REALITY (are we really a rich nation?)

While the UK has one of the largest economies in the world measured by GDP our finances are shaky to say the least.

Our national debt is £2.25 trillion (one trillion is a million million). (our nation debt is still increasing by £5170 per second)

Which breaks out to a debt of £36,254 per citizen

and £62,357 per tax payer.

Currently the UK is spending £43 billion per year on interest to service the national debt. (this figure equates to 25% of the NHS budget)

We are currently spending £30,000,000,000 (30 billion) per year more than we are raising so our national debt continues to increase. Before the "austerity" cutbacks we were borrowing £150,000,000,000 to fund our expenditure on things like the NHS. This was unsustainable.

(If you are a parent - you must be aware the national debt we continue to pile up now will be a burden for your children to deal with when they become adults.)

PLEASE SEE THE NATIONAL INCOME AND EXPENDITURE CHARTS BELOW.

FUNDING THE NHS - THE REALITY

If you want to argue the NHS should have more funds you have a responsibility to show where the money is going to come from given the backdrop that we are currently spending much more as a nation than we are earning. Decisions have to be made. ( I guess a lot of people point to the defence budget - some on the International Aid budget - small beer).

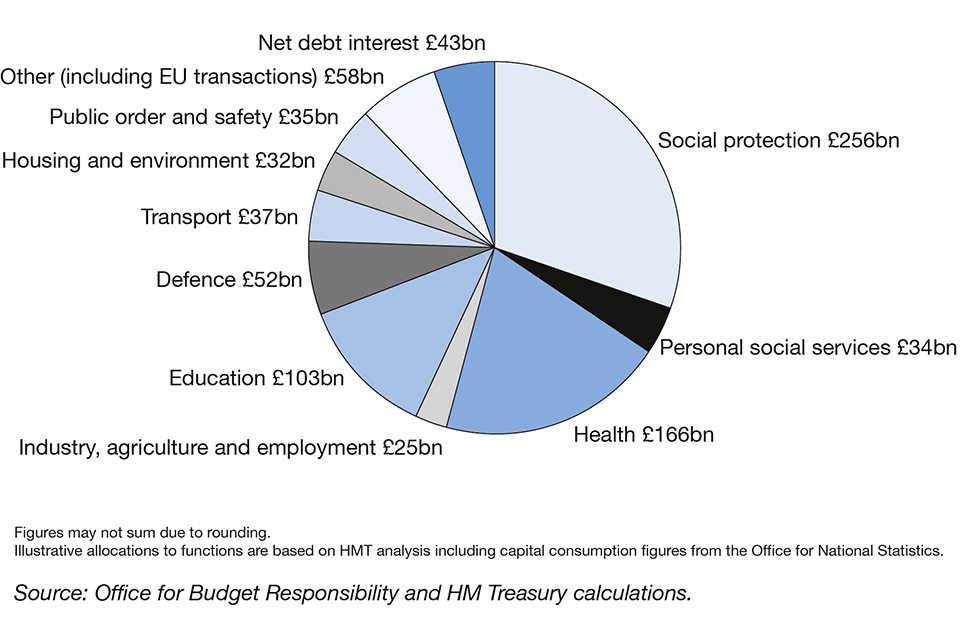

Chart 1 below currently shows our public sector spending. Do you recognise one area on that chart than is not calling out for more money? Where would you make cuts?

Chart 1: Public sector spending 2019-20

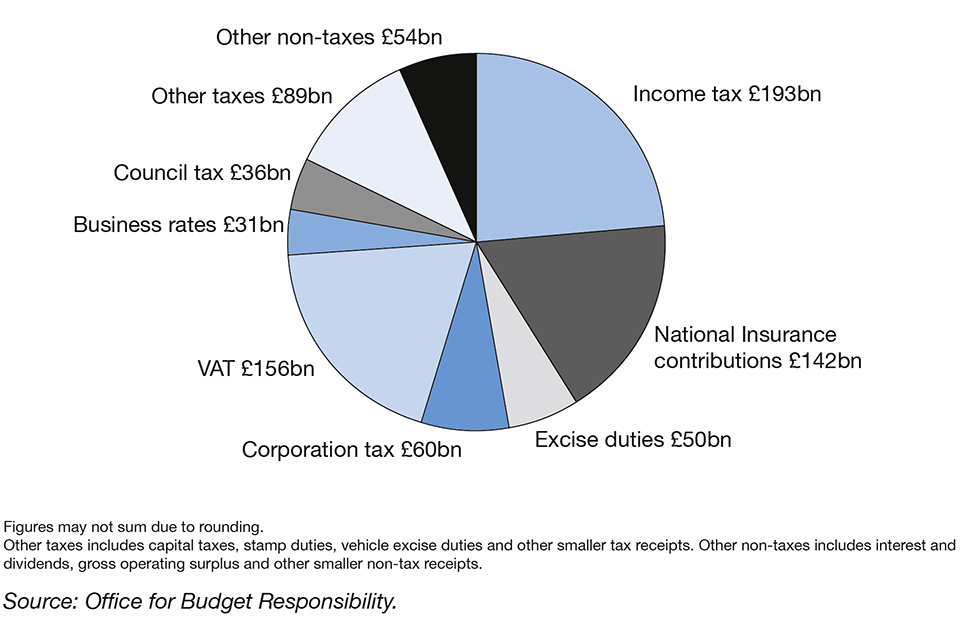

So if it is hard to find extra money for the NHS by cutting elsewhere and we are trying to reduce the amount we are borrowing each year the only answer is to raise more money from taxation. Chart 2 below shows current sources of UK income.

This is where the debate can get particularly heated (political - socialism v capitalism). It is easy to say we can raise tax rates for the rich, and tax corporations more particularly the big global companies like Google and Amazon. Here are some harsh realities many people do not want to hear leave alone accept :-

- For an economy to be dynamic - entrepreneurs and high achievers need to feel rewarded for their effort. That is a prime motivation. If you tax too highly they go elsewhere to pursue their business and careers - tax revenues fall. (see France).

- If our corporation tax rates and terms of doing business are not competitive with other countries, international companies will either relocate elsewhere or not come here at all. Tax revenues fall.

- If inheritance tax rates are too high - people hide their money or find ways to mitigate their tax bill. Tax revenues fall.

- There is a world wide problem with taxing global companies like Google & Amazon. Currently we are unable to tax them unilaterally. This is a complex issue beyond one nations control. There is no easy answer to it because it requires international cooperation.

- If you put up employers NIC too high it often results in job losses.

- If you increase VAT people spend less - or use cash. Tax revenues fall - unemployment increases.

- If you increase business rates businesses struggle (High Street businesses are pressing for cuts). Businesses close. People lose jobs - tax revenues fall.

So stating the obvious it is not so easy to increase tax revenues. The only real and sustainable way to do it is by creating conditions were business can flourish and real wealth is created. (where GDP per capita increases - where peoples share of the national GDP cake that can be taxed becomes larger. This requires our businesses to become more efficient - more productive per head of population). As Margaret Thatcher famously said - compassion is rarely enough - you have to earn it first before you can give it away.

Chart 2: Public sector current receipts 2019-20

So back to the NHS budget and the provision of expensive drugs like Orkambi.

So back to the NHS budget and the provision of expensive drugs like Orkambi.

No comments:

Post a Comment